Budget Better in Qmlativ: Automate Your Payroll Encumbrances

|

Erin Werra Blogger, Researcher, and Edvocate |

By far the biggest budget expenditure for any school district is payroll and benefits for staff.

There are ways to forecast it by individual, but scaling that process quickly becomes unreasonable. Payroll encumbrances will change every time an employee’s status or salary changes, a constant ebb and flow of subtle changes to the budget.

Needless to say, it’s a bit overwhelming! Fortunately, Skyward’s payroll encumbrances tool has you covered. It does all those manual calculations for you, so you can save time and rest assured the predictions are accurate.

But before we dive into this tool, let’s take a step back and talk about what exactly payroll encumbrances are.

What is a payroll encumbrance?

About 80% of the yearly budget will go toward salaries. When districts forecast that figure and set aside funds for payroll, those funds are called a payroll encumbrance. Because the funds are already spoken for, the budget will always reflect the amount you need to pay staff.These calculations take place at the district level, so any employment changes across the district will have an impact. Some are obvious (like hiring and terminating) and some, not so much.

Payroll encumbrances will change when:

- FT status changes

- Salary changes

- Benefits eligibility changes

- Contracts change

- Leave of absence is needed

- Budget cycles end

- Funding ends

How are payroll encumbrances managed in Qmlativ?

Note: The Help Center features an interactive checklist that guides you through the steps of processing payroll encumbrances from start to finish.

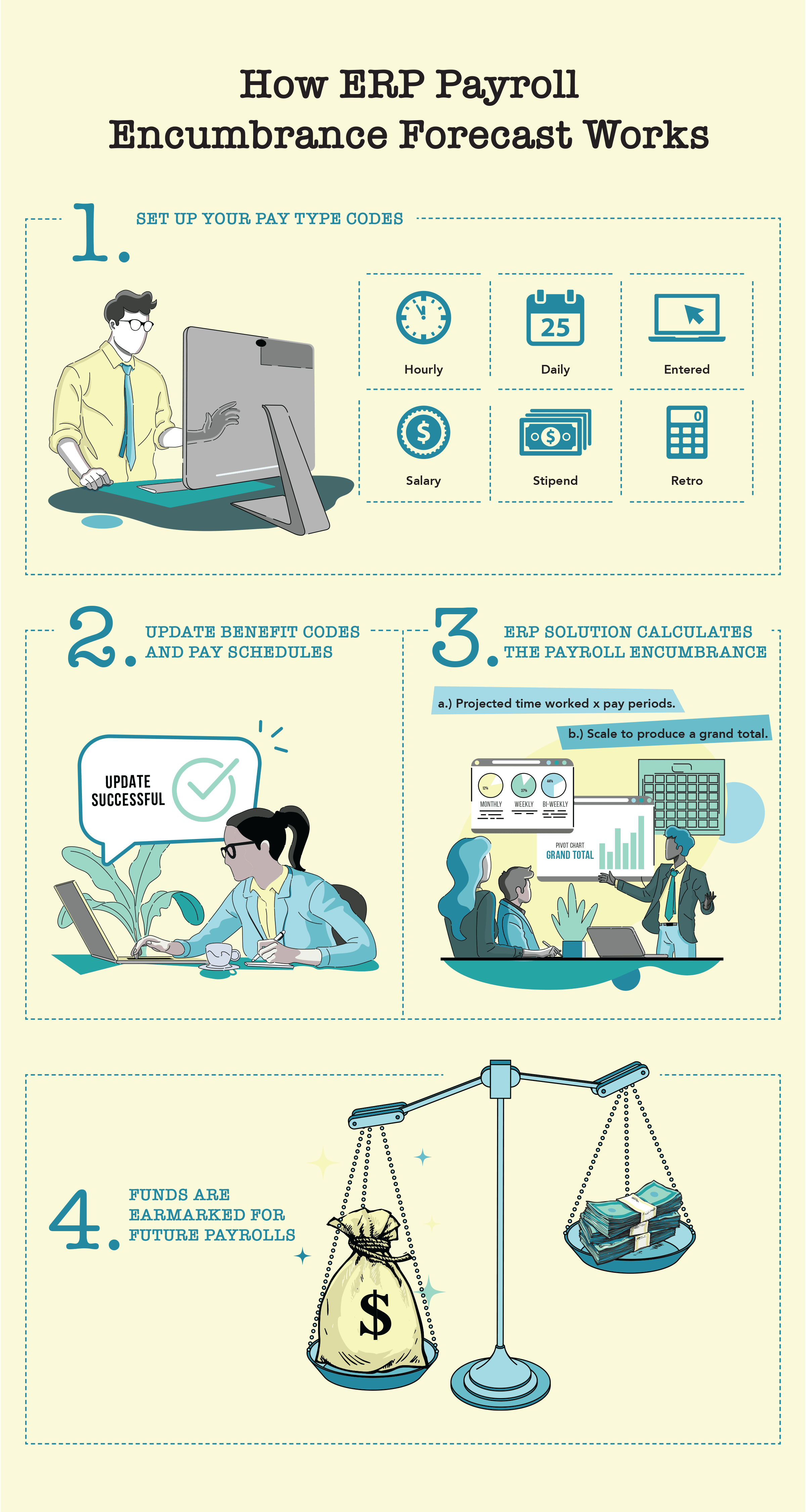

Step 1: You’ll set up your employee pay type codes in Payroll. (The calculation for each employee's pay is based on how their pay type code is set up.) Codes may include hourly, daily, entered, salary, stipend, or retro pay. Dive into the exact calculations in the Help Center.

Step 2: You’ll update all benefit codes and pay schedules. Payroll encumbrances are designed to anticipate a payroll, so all the payroll data must be accurate before a forecast can be accurate. Again, you can find all the benefit code setups and associated payroll encumbrance calculations for each option in the Help Center.

Step 3: Skyward will take over the arduous task of calculating the projected time worked by each employee, multiplying that time by pay amounts by pay periods in a calendar year—and adding each figure to the forecast to produce a grand total. (If that line has you scratching your head, just be glad you don’t have to do it manually!)

Step 4: Your future payroll funds are earmarked—you're ready to go!

Keeping payroll encumbrances up to date is a time-consuming task. Don’t spend another hour tackling this process manually. Skyward is here to help!

Follow-Up Resource: Qmlativ Spotlight: Negative Net Check Processing

If your district has a lot of employees working less than normal hours, chances are, negative net checks have become a burden. What if this process was no longer manual?Thinking about edtech for your district? We'd love to help. Visit skyward.com/get-started to learn more.

|

Erin Werra Blogger, Researcher, and Edvocate |

Erin spent sixteen+ years learning, then launched a professional career delving into the inner workings of practice, data, and edtech in K-12 schools. She is always looking to deliver more insights to help you work smarter every day.

Get started

Get started