Prepare Your Summer Payrolls

|

Skyward Insider Team Skyward Experts |

As we approach the end of the year, planning ahead for business office tasks can help the summer go smoothly. In particular, it’s important to plan for teacher payrolls over the summer and ensure those expenses will be posted in the current fiscal year.

Different states have their own requirements for payroll records. We recommend talking to your auditor about your specific requirements for recordkeeping.

To prepare for summer payrolls, we’ll use the payroll payables option. It allows you to expense payroll checks in one fiscal year but run and print the checks later in the next fiscal year. Employees receive their paychecks during the pay period as planned, but expenses are already taken out in June before the fiscal year ends.

Skyward was designed for this process—it’s built into the system. It’s a good way to plan, work ahead, and minimize errors in budgeting and recordkeeping. Potential changes to employees’ direct deposit or ACH transfer info won’t affect upcoming payroll. Most importantly, it allows for expensing back to the current year while keeping scheduled payroll dates for actual fund transfers. Here's how to use payroll payables.

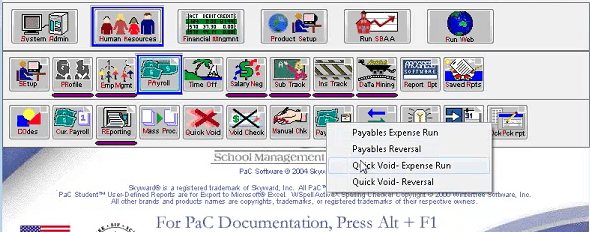

Expense Run

The first step is called an expense run. In June, run the teacher payroll numbers you expect to pay out for July/August via the payroll payables expense run option built right into your system. Double check your state reporting requirements before you begin this process!

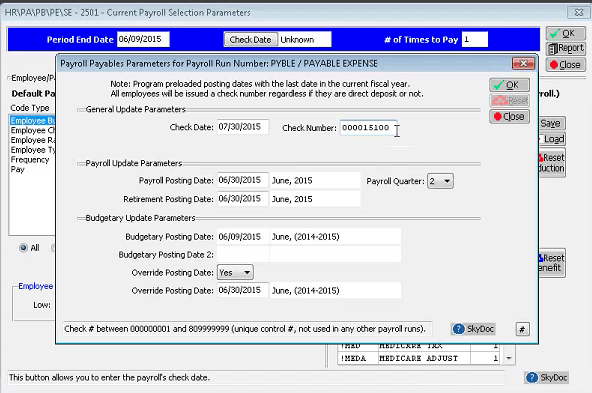

Set up the correct payroll and check dates:

- Select expense run and you will see buttons come up, similar to a normal payroll. Work left to right as usual.

- Change auto-filled check dates to the actual payroll date. This is very important for state reporting.

- For payroll posting and retirement posting dates, keep the expense date if your state requires it.

- Update the check number, which in this case only functions as a transaction number (actual check numbers will be given during the actual pay period payroll). Payroll quarter can stay the same.

- Check on the period end date in the top left corner to make sure it’s the last day of the fiscal year, if this is what your state requires.

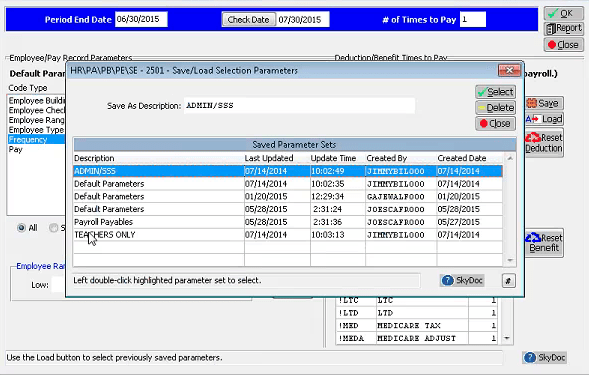

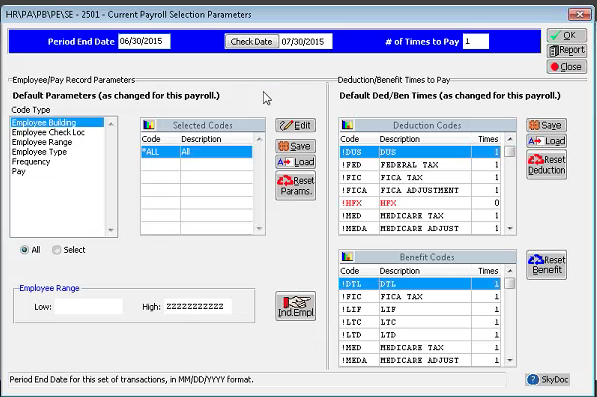

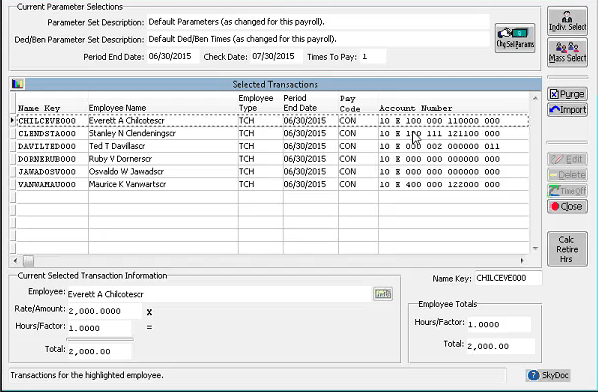

Next, pull in employees. This process is similar to a normal payroll, but we need to be very specific about who is involved (probably only teachers—do not pull in 12-month employees).

- Use parameters to pull in employee types to get the right employees pulled in (save the setup to use the process later).

- Double-check deductions and set any that aren’t withheld in summer to zero.

- Run the mass select based on previous parameters, then double check and use individual select if needed.

Next, pre-verify, calculate, check exceptions, and run post-verification reports like you would with a normal payroll. Expect a few more changes than usual on reports.

- ACH deductions: These won’t be calculated in this process since it’s not actually creating an ACH file yet (that will happen during the actual pay period).

- Accounting register: Cash doesn’t get hit in the payroll payables process until the live payroll run—liability accounts act as holding tanks to run the expenses.

- Invoice report: Payroll payables process does not create invoices until the live payroll run.

The update button finalizes the payroll payable file, and changes are no longer possible (unless you use a void process). This process won’t result in printed checks or ACH files until the live payroll run. Go ahead and repeat the payroll payables process for any other summer pay periods.

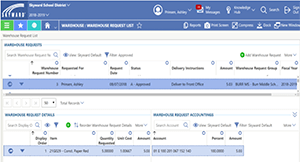

Reversal

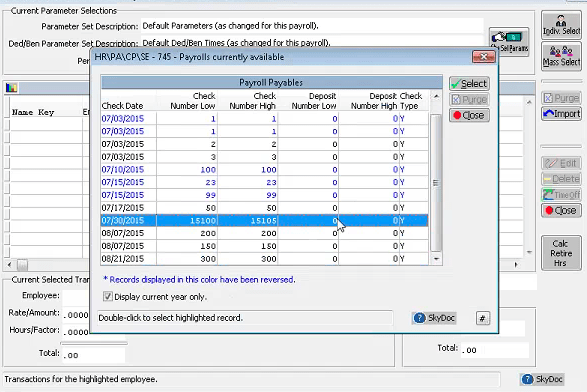

Run the payroll payables reversal process just before the actual payroll. You’ll be left with the expenses hitting the previous year and a paper check/ACH deposit in hand. The reversal and actual pay run wash in terms of accounting. It looks like a shortened version of the payroll process, so work left to right in the software.

- All available payroll payables runs are displayed, so double check the pay period date. (Plus, any already reversed will appear in blue.)

- Double check state requirements for dates—most will be the check date, except retirement process date.

- There’s no check number (yet), so instead match the transaction number you created from the expense run.

- Run check register and save reports.

Payroll accounting wash

Time to run the actual payroll. It's tempting to run a single payroll, but to keep the dates accurate, it's best to run a payroll payables group and a separate payroll for 12-month employees.

- Working in the actual payroll area, double-check your payroll dates, since they need to match the reversal dates in order to result in a wash.

- Add actual check dates.

- Bypass the parameters selection and instead import your payroll payables (it should be blue since you've run the reversal already).

- Reversal and live run will result in a wash.

- You’ll be left with checks or an ACH file.

- Run any adjustments for benefit deduction updates in a mass process.

Taking these steps well ahead of summer sets you up for enjoying the time of year when students and teachers are on break just a little more. Payroll payables gives you a secure way to credit your teacher payrolls to the correct fiscal year, without resorting to risky methods of juggling or holding checks between years.

What are you waiting for?

Follow-up Resource: Skyward Support

If you’re looking for guidance or support when preparing for summer, we’re here to help. Find support or submit a service call.Thinking about edtech for your district? We'd love to help. Visit skyward.com/get-started to learn more.

|

Skyward Insider Team Skyward Experts |

Get started

Get started