COVID-19: Documenting for State & Federal Funding

|

Caitlin Barton Product Manager |

No one saw this coming. It’s not something we prepared for. Coronavirus has all but taken over our world, closing schools, suspending sports seasons, and making “social distancing” a social norm. But in the midst of this uncertainty, we can certainly do our best to prepare for what’s to come in the weeks and months ahead.

Currently, no official guidance has been provided at the state or federal level that COVID-19 related expenses will be eligible for state or federal reimbursement. Some customers are choosing to flag certain expenses in the hopes this information will help if and when the possibility of reimbursements is addressed.

So how can you document these expenses?

Qmlativ

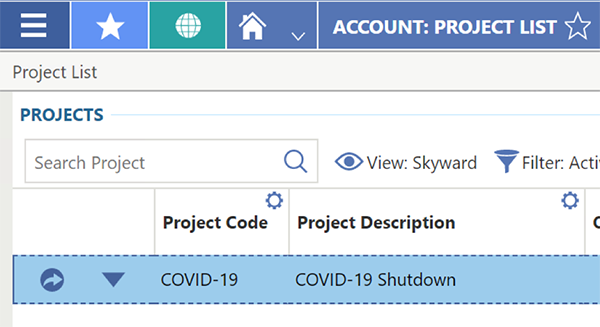

Projects provide an easy way to isolate and track these expenses. Start by creating a project and giving it a code such as “COVID-19.”

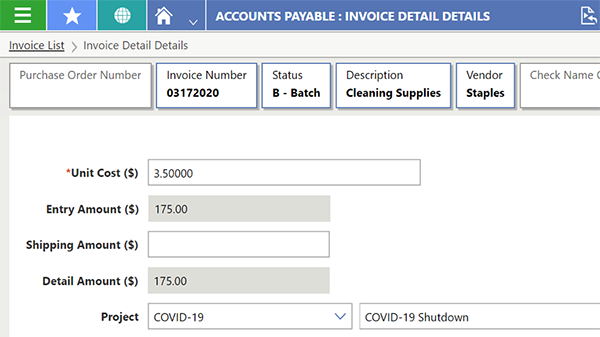

Then start tying actions to this project. For instance, on the Invoice Details screen, all accounts payable invoices related to the shutdown should be coded to the project “COVID-19.”

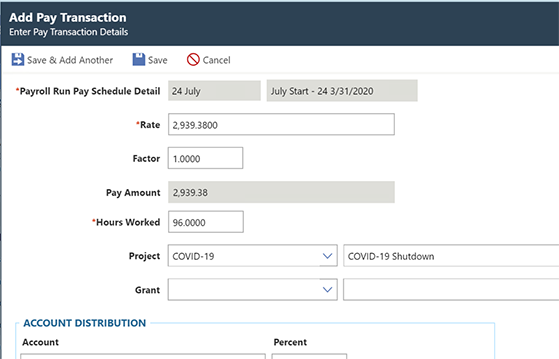

All timesheets related to the shutdown (for instance, staff called in to work) should be coded to the “COVID-19” project on the Pay Transaction Details screen. Note: You can add codes to transactions at any time, even if they are in History status.

SMS

For SMS customers, there are two options for tracking expenses:1. You can use the Project/Grant Management feature to isolate and track COVID-related expenses. Start by creating a project and giving it a code such as “COVID19.” The Project/Grant field is available to use on pay records, during requisition/PO and invoice entry, and on cash receipt and journal entry screens.

2. If your existing account code structure allows adding of locally defined codes, you can add a new code for COVID-19 and then create new expense accounts with the new code.

Note: For both options, codes are required on a transaction prior to an Accounting Update being done. Once a transaction has moved to history, journal entries are required to track expense amounts to a project code or move expense amounts to a different expense account.

Option 1

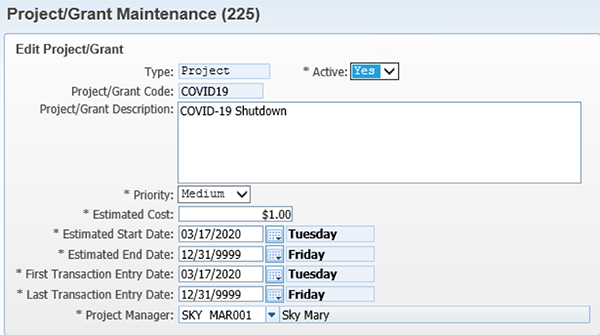

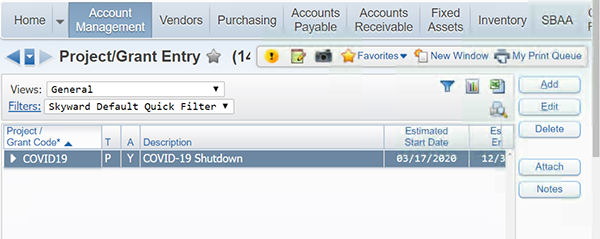

To use the Project/Grant Management feature, go to WF\AM\PG, Project Grant Entry. Add a new project code.

- Enter an Estimated Cost = $1.00. (This field must have a non-zero value.)

- The Estimated Start Date and the First Transaction Entry Date should be equal to the first date you will enter a transaction using the new project code. The Estimated End Date and the Last Transaction Entry Date can be left as is. You can edit these fields later when you are ready to cutoff use of this code.

- Select a Project Manager for this project. (This is informational only.)

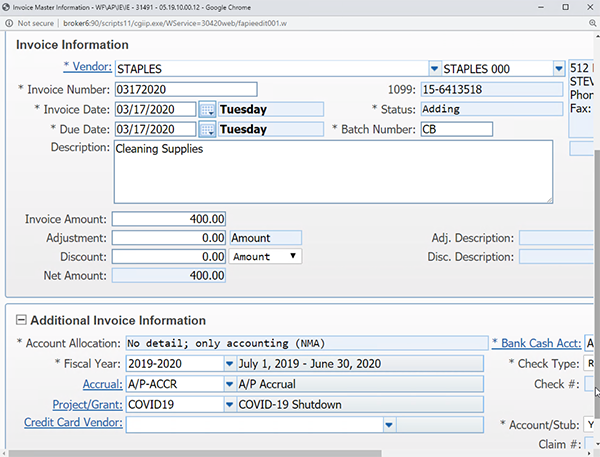

Once the project code is added, you can start tying actions to this project. For instance, on the Invoice Information screen, accounts payable invoices related to the shutdown can be coded to the project “COVID19.”

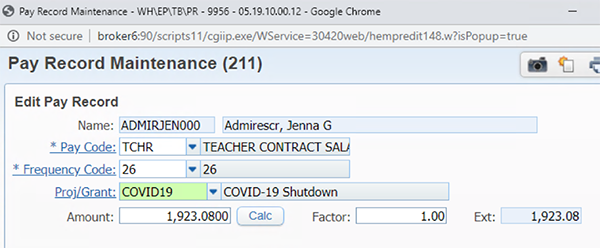

On the Pay Record Maintenance screen, assign the “COVID19” project code to Pay Records you want coded to the COVID19 project. (The Project/Grants Account Activity Report will include benefit expenses associated with this salary expense.)

By tying all appropriate expenses to a project code, it will be easy to isolate them when you need to provide documentation in the future.

Option 2

To create expense accounts specifically for COVID-19 expenses, determine if you have a local option dimension in your existing account code structure. Be thoughtful about if this option works for you. If your state dictates the allowable values for every dimension of your account code structure, this option will not be a good choice for you.

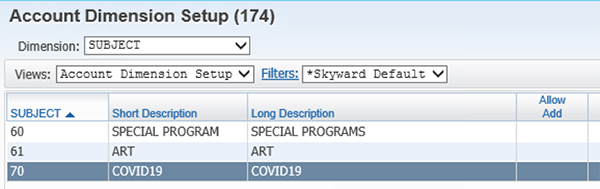

To add a new code, go to WF\AM\PS, Configuration, Account Setup, Account Dimension Setup.

Select the appropriate Dimension. In this example, this customer is in a state where the Subject dimension can be used for locally defined codes. They added Subject Code “70” with a COVID-19 description.

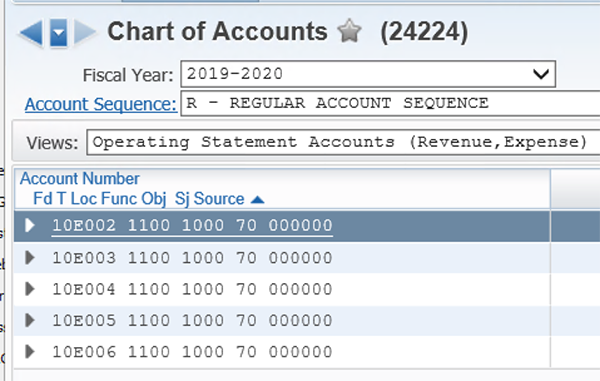

Once the code is added, add new expense accounts either in Account Profile or in Chart of Accounts.

By creating unique expense accounts with a COVID-19 locally defined code, it will be easy to filter reports to identify transactions using these expense accounts.

Though we can’t predict what the future will hold, we can do our best to prepare for it today. We’re all in this together.

Follow-Up Resources for Going Remote

Remote Ready ToolkitNavigating COVID-19 with Skyward

4 New Tools for a Smoother Ride This School Year

Thinking about edtech for your district? We'd love to help. Visit skyward.com/get-started to learn more.

|

Caitlin Barton Product Manager |

Get started

Get started