As defrauded districts look back and connect the dots, most never expected to discover a criminal in their midst.

We hope no one would ever take advantage of our trust, but there are multiple ways for employees to hide fraudulent schemes. Before your district falls victim, double-check these hotspots for siphoning funds, influencing district income, and embezzling money.

1) Vendor fraud

This process consists of employees creating sham vendors to funnel money to accounts belonging to themselves, family, or friends. Double-check your accounts for clues which may indicate fraud is occurring.Ask for vendors’ mailing addresses instead of just a PO box. Pay attention to vendors’ contact information and be wary of any overlap with current employees’ information. Verify tax ID numbers. Conduct a self-audit with an eye toward any conflicts of interest with employees. If you have reason to suspect foul play, consider employing a third-party review of vendors.

Data mining can help catch fraudsters, too. Here are some reports to peruse which may indicate vendor fraud:

- Payments just under approval limits

- Manual check payments

- Special payments outside of normal procedures

- Out-of-sequence invoice or check numbers

- Non-numerical characters, or other deviations from typical numbering systems

- Different delivery and payment addresses

- Duplicate payments on the same day or within the same payment cycle

- Vendors outside of your typical geographic region (if you contract with primarily local vendors)

2) Ghost employees

They may not go bump in the night, but they can cause quite a bump in the budget. Ghost employees are false hires who pull a normal paycheck—funneled right into an untrustworthy employee’s account.Administrators can add extra barriers to ghost employee scams by assigning different people to employee entry and payroll tasks. Then create an extra layer of payroll approval. Even with these checks and balances in place, savvy scammers can swindle employers out of big bucks in payroll schemes. Anomalies like records printed on different colored paper, odd typefaces, and checks with dual endorsements are clues worth investigating. It’s always a good idea to encourage the use of direct deposit, which makes siphoning payroll funds much more difficult.

Finally, there’s the nuclear option in a payroll fraud audit: Run a payroll cycle of all paper checks. Hand-deliver them and ask for identification upon receipt.

This form of fraud also has some data-mining techniques to try in order to nab a scammer:

- Employee numbers outside your typical range

- Missing withholdings for taxes or Social Security (ghosts don’t pay taxes)

- Missing personnel files

- Net payroll imbalance

- Multiple payments to a single account under different names

3) Timesheet padding

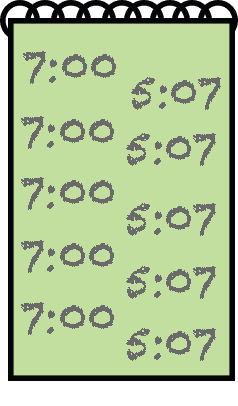

This costly form of fraud can either trickle in as employees nickel-and-dime a few unworked minutes or flood your payroll budget with hundreds of fraudulent workdays tallied over months.Using paper timesheets considerably increases opportunities for fraud. Errors or deliberate padding during manual data entry can add up quickly. This is especially true if employees are able to put off time entry until the end of the pay period, when the chance of conscious or accidental mis-entry is much greater.

More insidious time theft practices include “buddy punches”—asking a friend to punch in for them if they’re running late or punch out after they’ve already skipped town for the day. This is especially easy on paper timesheets kept in a common area, such as a lounge or office, where there’s no security. Finally, the boldest type of timesheet padding is noting a full day’s work when the employee hasn’t worked at all. Counter paper timesheet fraud by requiring supervisors to review timesheets.

Even if your district has transitioned to more secure electronic timesheets, in a connected world, it’s not unusual to see employees working at odd hours as the muse (or family schedules) moves them. One tipoff of timesheet tomfoolery is a pattern of nice, round numbers in an employee’s punches—maybe the employee is simply consistent, or maybe they’re editing and padding timesheets. Fortunately, digital time clocks make it much easier to review punch modification histories if you have any concerns.

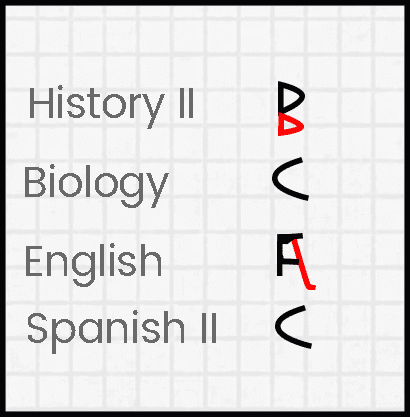

4) Grade changing

Remember Atlanta? Grade changing not only hurts students, it can also lead to life-altering consequences for complicit educators and administrators. Sadly, educators take part in the process for countless reasons—cultures of fear, threats, and uncertainty not least among them. If you suspect grade changing is happening in your district—say for example you notice drastic graduation rate changes in a short span of time or become aware of batch changes to grade input fields—here are some ways to address the issue.- Clarify the policy and the high stakes of grade changing—for teachers, administrators, and for the students caught up in the scam—and provide training.

- Automate recordkeeping when possible, and make sure your system enables you to audit the entire history of a given grade—including who changed it and when.

- Strengthen data security and monitor users’ security privileges.

- Increase accountability and improve culture. Yes, funding and enrollment may depend on achievement metrics, but the risk never outweighs the reward.

Finally, check in with your school’s climate. Authoritarian, metric-obsessed schools and districts make up the overwhelming majority of grade-changing culprits.

5) Ghost students

Since funding is so closely tied to student counts, padding rosters with “ghost” students allows unscrupulous districts to receive additional funding, better school ranking, and better principal evaluations. Officials at Chicago Public Schools were discovered changing absence records for students who cut classes or missed partial days. The schools were struggling to improve and to serve disadvantaged youth and ended up giving in to the pressure by falsifying data.In the same district, officials also neglected to remove students from their rosters who had dropped out, who were truant, or who were missing. Instead, the district indicated the students had transferred to a home school. Concealing dropouts this way cast graduation and attendance rates in a better light.

Regardless of the intent, misrepresenting student records has very serious consequences for districts—and students. In this case, teachers were upset to have been caught up in the scheme, and underserved youth in difficult situations did not receive the education they were entitled to and desperately needed.

6) Misuse of special education funding

The nebulous nature of the Individuals with Disabilities Education Act (IDEA), which guarantees a free and appropriate education to students in need of special education, creates an opportunity for deceitful individuals and organizations to scam schools. New York auditors discovered millions of dollars in misappropriated special education funds—ranging from dollars diverted toward payroll for a whole roster of fraudulent employees to blatant personal spending on a provider’s private home.Here are a handful of red flags to look for when auditing your special education funds:

- Altered or missing documentation for students or funds

- Vague line items, e.g. “supplies” or “conferences” without details about their relationship to special education

- No separation of duties for special education teachers

- Non-competitive contracts for providers or organizations

- False or missing credentials for third-party providers contracted by the district

- Nepotism among third-party providers contracted by the district

- Reluctance to comply with auditors

- Failure to return funding if student withdraws

One of the best ways you can help prevent fraud is by mentioning to your team you’re on the lookout for fraud—without disclosing all of your methods. Trust is important, but verification is essential. One without the other is a recipe for disaster.

Follow-up resource: Buzz from the school business office

One of the best ways to stay ahead of fraud is to stay connected to what's happening in the world of school business. Now, there's a whole new way to connect and network with other SBOs around the world on Twitter—read all about it in this guest post: Introducing #EdFinChat.WHAT'S NEXT FOR YOUR EDTECH? The right combo of tools & support retains staff and serves students better. We'd love to help. Visit skyward.com/get-started to learn more.

|

Erin Werra Blogger, Researcher, and Edvocate |

Erin Werra is a content writer and strategist at Skyward’s Advancing K12 blog. Her writing about K12 edtech, data, security, social-emotional learning, and leadership has appeared in THE Journal, District Administration, eSchool News, and more. She enjoys puzzling over details to make K12 edtech info accessible for all. Outside of edtech, she’s waxing poetic about motherhood, personality traits, and self-growth.